Update 12/5/20 - The furlough scheme will be extended through to the end of October 2020. No changes will be made to the rules or the 80 percent cap until end of July. From August employers are expected to allow staff to return to work part-time and the employer's pay some of the wage, with the government providing support for the remainder.

Original article follows below:

The furlough scheme could be extended to September under proposals being considered, however the scheme would not retain its current structure.

The current furlough scheme (JRS) for PAYE employees pays out 80 percent of an employee's wage bill (up to £2,500 per month) to the employer (plus other related costs). This covers the cost to the business of the employee and helps to avoid redundancies. In a similar fashion, self employed people are having their income covered at the same ratios under the SEISS scheme.

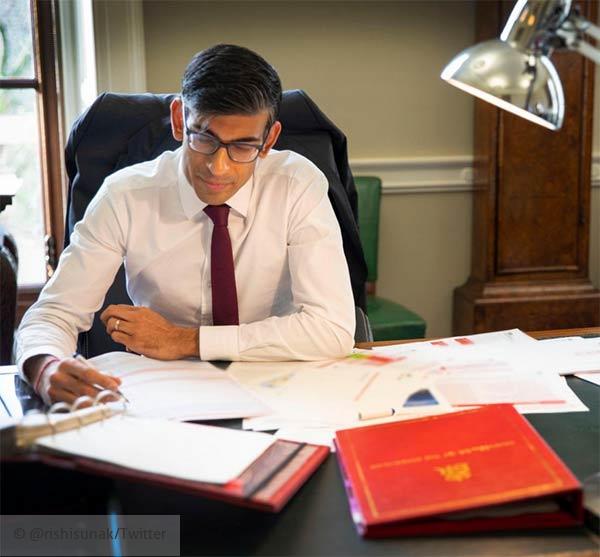

The Chancellor Rishi Sunak is now considering plans on how to adjust these schemes as plans to re-open the economy and encourage people to head back to work are drawn up. These schemes would be adjusted but in a tapered manner. Ideas being considered include gradually reducing the limit of payouts, starting with a cut from 80 percent of income to 60 percent of income. This is to encourage people to look for alternative work to make up their income shortfall if they cannot work with their normal employer.

Another idea being mooted is to allow furloughed staff to return to their regular job with their employer receiving gradually less assistance toward wage costs. A similar scheme in Germany (Kurzarbeit) allows employees to work less hours with altering work patterns thereby maintaining social distancing policies. Workers under the Kurzarbeit get 60 percent of regular pay via state assistance.

These sorts of ideas are in consideration in other countries too as they decide how to drip-feed resume the economy. Over six million people staff are currently furloughed in the UK at unsustainable cost to the Treasury - a cost expected to reach over £40 billion by early Summer, and if continued in its current form, over £10 billion a month thereafter.

At the maximum cap on furlough payments to the employee remaining at £2,500, a cut from 80 to 60 percent would see a further cut to monthly gross income of £625 at the maximum.

| Regular Monthly Gross | 80% Furlough Gross/Net | 60% Furlough Gross/Net |

|---|---|---|

| £3,125 and above | £2,500 / £2,003 | £1,875 / £1,578 |

| £3,000 | £2,400 / £1,935 | £1,527 / £1,342 |

| £2,750 | £2,200 / £1,799 | £1,650 / £1,425 |

| £2,500 | £2,000 / £1,663 | £1,500 / £1,323 |

| £2,250 | £1,800 / £1,527 | £1,350 / £1,221 |

| £2,000 | £1,600 / £1,391 | £1,200 / £1,119 |

| £1,750 | £1,400 / £1,255 | £1,050 / £1,017 |

| £1,500 | £1,200 / £1,119 | £900 / £887 |

| £1,250 | £1,000 / £975 | £750 / £750 |

| £1,000 | £800 / £799 | £600 / £600 |

Any tapering of furlough/SEISS will likely be commence from the end of June, while SEISS could possibly begin tapering earlier. Whereas the furlough scheme was extended officially, SEISS did not have an official extension - though the Chancellor did state that payouts were to be provided initially in a three-month's worth lump sum and then monthly thereafter if required. The self employed could see the 'cliff-edge' £50,000 turnover cut-off reduced to £30,000. This would mean that any self employed person who had a turnover average of more than £30,000 in previous years would no longer receive SEISS support from June.

Crucially he has said there is not to be a cliff-edge removal of the schemes, which guarantees some form of gradual winding down.

Prime Minister Boris Johnson is to announce the plan to lift lockdown restrictions this Sunday and we should hear from Chancellor Rishi Sunak sometime soon after that.