Update 29/5/20 - SEISS officially extended for a further 3 months. Applicants will receive support for the months of June, July and August in one claim made in August. The percentage has been changed as has the maximum monthly cap. 70 percent per month based on previous profits, capped to a max of £2,190 a month.

Update 6/5/20 - Applications for the SEISS will open from Wednesday May 13th. In the meantime people can check their eligibility using the HMRC tool at https://www.tax.service.gov.uk/self-employment-support/enter-unique-taxpayer-reference. If eligible the tool will give you your application date. First payments (covering Mar, Apr and May) are to be transferred within six working days of your application. Our own calculator below will give you an estimate now of how much your payment would be.

Update 26/3/20 - The Coronavirus Bill passed the House of Lords and received Royal Assent and today the Chancellor has confirmed the scheme. Below are the rules of the Self Employed Income Support Scheme (SEISS) and further below is a calculator to check how much you can receive:

- Taxable grant paid each month directly from HMRC of up to 80% of gross income or £2,500, whichever is lower. From June these numbers change to 70% and £2,190 respectively. Once ready you will fill an online form at HMRC to enrol.

- Open to those who have majority of income from self employment (more than 50%), have submitted a tax return for year ending April 2019 (or will do within 4 weeks of now by April 23rd 2020), must be registered already as self employed and have trading profits of up to £50,000 (basic rate taxpayers)

- People must have traded in the 2019-2020 tax year and intended to continue trading in the 2020-2021 tax year

- The scheme is open if you have a trading profit of below £50,000 in 2018-19 or an average trading profit of below £50,000 from 2016-17, 2017-18 and 2018-19.

- Scheme will be up and running to apply by early June - so claims for grants will be backdated to March 1st 2020. HMRC is aiming to contact people by mid-May if they are eligible with an invite to make an online claim (or an alternative offline method).

- The income figure is taken from trading profit filed via tax returns averaged over the last three year (As in the calculator below). If less than three years are available, then the average of what years are available is taken. For those very recently self employed they are excluded from the scheme and will have to fallback to universal credit.

- Directors of limited companies are excluded from the SEISS scheme. This includes those that use PSC (Personal Service Companies). However, directors are allowed to furlough themselves as long as they do not carry out activities any further than required by the Companies Act 2006.

If the calculator below does not display, please click here to reload the page.

HMRC will use existing data to figure out who is eligible for the scheme and send out invites for people to apply automatically once their systems are ready (applications start from May 13th 2020). The first payment will cover the months of March, April and May.

Those that are 'self employed' but within a limited company and pay themselves via salary and dividends, the Chancellor stated they should fallback to support for employees via the Coronavirus Job Retention Scheme on PAYE schemes.

The original article follows below - the below information regards the first tabled versions of the bill, prior to the latest information above.

Earlier today Chancellor Rishi Sunak responded to questions in parliament that echoed the widespread sentiment of the UK's 4.9 million self employed, that being, "...what proportionate support will we receive?"

Sunak responded that the Treasury have been working and are continuing to work on sufficient and proportionate support for self employed people, freelancers and gig workers. The reason for the time taken before announcement is due to technical issues with implementation and making sure all the necessary people that need support are covered effectively. There will be more revealed and an announcement made later in the week - this schedule has been echoed by numerous publications in the media.

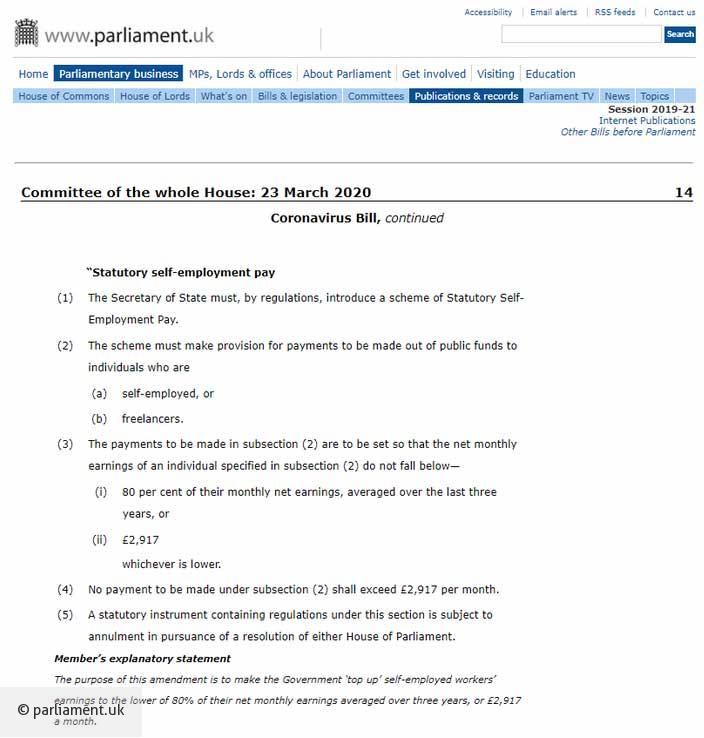

Doing the rounds on Twitter is a copy of the tabled Coronavirus Bill from the Parliament website (read page 14 of the PDF), which states a "statutory self-employed pay" must be implemented to make payments to self-employed and freelance people.

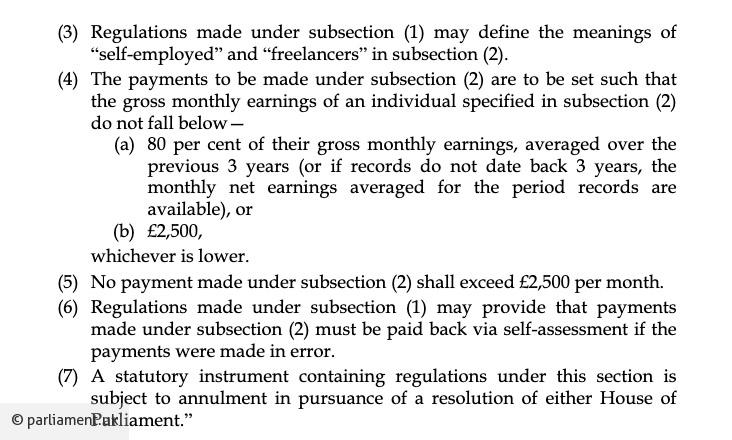

This bill was then amended to change a few details regarding the implementation and limits of payouts under the scheme, you can read those here in the latest Hansard (25/3), shortly before the Coronavirus bill received Royal Assent.

The bill doesn't go into any detail further than that the payouts must cover 80 percent of gross monthly earnings or £2,500, whichever is the lower amount.

Here are the amendments:

The gross earnings figure is arrived at by averaging the self assessment declared gross income from self employment from the last three years worth of tax returns. If three years of earnings information is not available, the average figure is arrived at from the years for which data is available.

Below is the old version of the bill:

If the income paid out by such a scheme is not enough to cover bills and other expenses combined, the government urges people to ask their lenders for mortgage payment holidays to reduce their expenses. The mortgage payment holiday calculator can help you see how your payments would be affected and how much you could possibly incur in additional interest on a typical mortgage. There is also an additional calculator on that website for loan payment holidays.

Some people have been arguing on social media that self employed people do not pay enough income tax. You can calculate the difference between tax on self employed people and employees on PAYE and see there is not much of a difference.