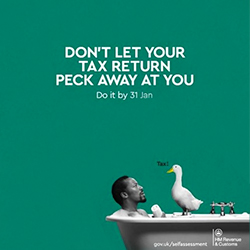

The Taxman is rolling out their annual campaigns to remind those who need to submit a self assessment tax return, around 11 million people, that the deadline is now 90 days away.

With the 31st Octover paper tax return deadline now over, HMRC is advising people to beat the Christmas and New Year's rush and get their finances in order early - avoiding any chance of potential errors in the final weeks as thus reduce any chance of penalties and fees.

Overload of HMRC systems is not uncommon toward the deadline date so filing early gets around this. Last year, even on Christmas Day over 2,500 people spent some downtime filing submitting their return.

It was also found that it took people last year three and a half hours to complete a tax return, and the trend was showing it was taking longer each year. By the end of 2018, over half of the tax returns required were still outstanding.

One week out from last year's online filing deadline, three million tax returns were outstanding.

Taxpayers who miss filing online by the 31st of January 2020 will have automatic penalty of £100 applied and further fees and interest are applied at regular periods thereafter while the tax return remains outstanding.

If with all the advance notice over the coming months you still manage to miss the deadline you could try blaming Witchcraft like some of these late tax return excuses.

We have a number of tools related to helping you with tax return planning, from our multiple income tax estimate to our payment on account calculator, these tools will quickly show how much tax you could owe and what your tax bill could be. You can test with these tools before you submit your full details via your Tax Return.

If this is your first time submitting a tax return read our tax guides.