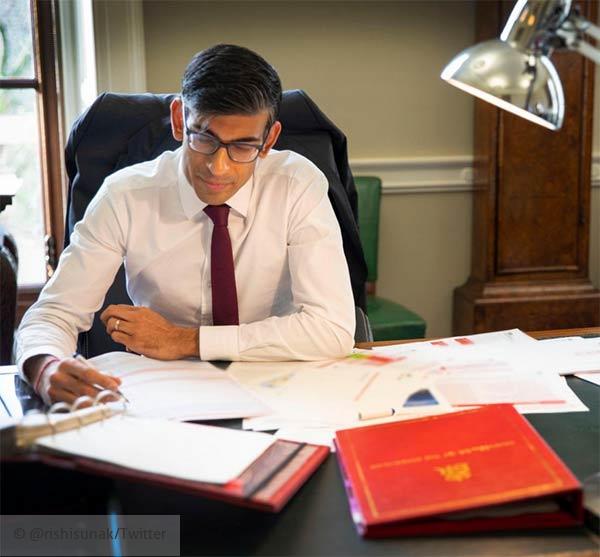

Chancellor Rishi Sunak's main aim during next Wednesday's (March 3rd) UK Budget will be to maintain the UK's economy, focusing on job retention by providing stimulus to avoid mass redundancies and foster new employment opportunities.

Unemployment has reached a six year high at over 5 percent, with the most hit being younger people and those in the retail, hospitality and leisure sectors; sectors that have previously received close attention by Sunak, such as the Eat Out to Help Out scheme.

It is thought Rishi Sunak's 'Plan for Jobs' will hit its next stage in the Budget.

Considering PM Boris Johnson has stated the UK will continue under some form of daily restrictions until at least June, Furlough and SEISS schemes are expected to be extended, rather than cancelled in the Spring as previously announced. However, expect tapering of the schemes as they head toward June.

The SEISS scheme will have its fourth installment detailed in the Budget, expected to be the same 80% capped to £2,500 covering the months of February, March and April with claim date to be announced. A fifth and final SEISS grant will very likely be altered to a reduced amount - covering up to June. Whether the Chancellor announces any help for limited company directors is unknown, however rumours of a scheme based on 2019/20 tax returns do exist.

The cost of income support schemes has contributed to record levels of UK debt. Many commentators believe that any major tax rises for individuals will be deferred until after the pandemic has been brought under control - with the focus in this Budget instead being on businesses with a hike to corporation tax - possibly to 25 percent (it is currently 19 percent).

Pensions have always had attention prior to Budgets due to the multiple ways a stealthy tax raid can occur, from abolishing higher rate tax relief to changing tax-free allowances limiting the amount of contributions to pensions. It is possible Sunak may freeze the lifetime pension contribution allowance resulting in a tax charge for those now breaching the limit.

Capital gains tax could be restructured to remove the two band structure. Rates are already set based on the type of gain, be it residential or any other types of asset. Sunak could remove the lower band and settle on one band, or, adjust the bands to match the 20% and 40% income tax bands (CGT is currently between 10% and 28%).

A combination of increased CGT and Corporation tax could be quite troublesome for landlords. Individual landlords selling up would suffer the increased CGT, while incorporated companies the higher corporation tax.

The housing market saw an unexpected boom, with prices defying the lockdowns and rising during the last year - most likely fuelled by the stamp duty holiday announced last year, with the zero band rating extended to values of up to £500,000. This relief is due to expire at the end of March and extending it would cost over £1 billion, but a sudden withdrawal could wobble property prices suddenly, so it will be interesting to see if it is extended and if so, for how long.

We'll keep an eye on any announcements next week and keep you updated. We have already published the tax rates and allowances for 2021 (they apply from April 6th) in our rates and allowances section. Tax calculators will be updated after the Budget in case of currently unknown announcements.