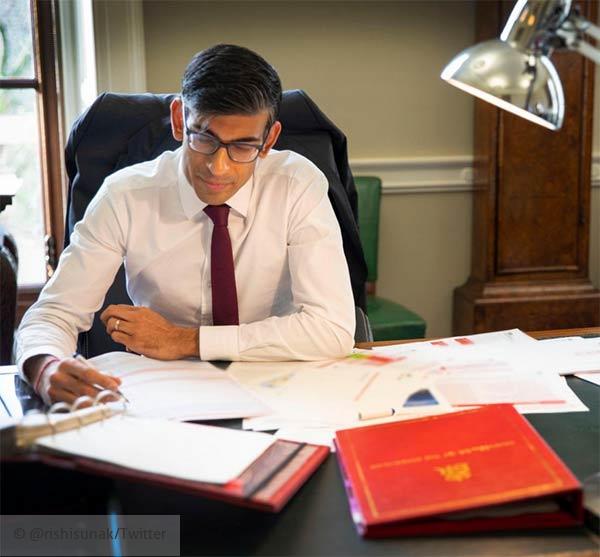

Rishi Sunak spent just over one hour giving his Budget speech, longer than the usual budget of recent years and mainly due to the extraordinary measures required for Coronavirus, which he spent considerable time detailing.

A £5 billion pound fund has immediately been created for the NHS but a total £30 billion fiscal stimulus package has been created in response to continguency plans brought on by the spread of the virus.

On top of this morning's base rate cut of half a percentage point to 0.25%, as well as increases to bank buffers, the three point plan by the chancellor revolves around providing support to the health services and those who will be directly affected by time off work. This includes personal finances, business finances, drops in consumer demand and supply chains.

Support will be provided for businesses with day-zero statutory sick pay requirements, with the government refunding up to 14 days of sick pay to businesses with fewer than 250 employees. Self employed people will be able to apply online or via phone for benefit support with day one claims allowed and the minimum income floor for universal credit removed. On top of this councils will be provided with shored up hardship funding.

Additional support for businesses in available if they are struggling with cashflow with a Coronavirus loan scheme offering loans of up to £1.2 million. Business rates are also abolished for those with a rateable value below £51,000. Pubs to get a £5,000 discount on business rates.

Income tax personal allowances, rates and thresholds are to remain frozen - so £12,500 tax-free allowance with the higher rate kicking in after £50,000 of gross income. This was detailed in the 2018 Budget as well as speculated before the Budget this year.

National living wage to increase to £8.72 an hour from April 2020, with a target of £10.50 an hour by 2024. National insurance primary threshold to increase to £9,500 this April, with the secondary employers' threshold to increase to £8,788 (inflation rise only).

Businesses will get additional NIC help with a £4,000 grant for those eligible as well as a one year break from employers' NIC for veteran employees.

Fuel duties are to remain frozen for an additional year, whereas Red Diesel has a timescale added to its removal in 2022. Alcohol duties are also to be frozen for an additional year.

There are a range of investments in roads, infrastructure and electric vehicle rapid charging. In the case of electric vehicles this is on top of the cut to zero percent BIK rates this April, making them an attractive proposition for company car drivers.

Corporation tax rate is to be held at 19 percent from April 2020 as disclosed during the election. Entrepreneurs' relief lifetime allowance to be reduced to £1 million.

Stamp duty to see a surcharge of two percent for non-UK residents.

The NHS pension problem is to be resolved using changes to taper thresholds by increasing them by £90,000 (up to £300k from the current £210k).

VAT on women's sanitary products (dubbed the tampon tax) to be abolished.

Overall economic growth forecasts show 1.1 percent growth this year (before considering virus impacts), with inflation set to hit 1.4 percent in 2020. Public borrowing is set to rise to 2.1 percent of gross domestic product.

Read more about direct tax changes and use our budget 2020 calculator.