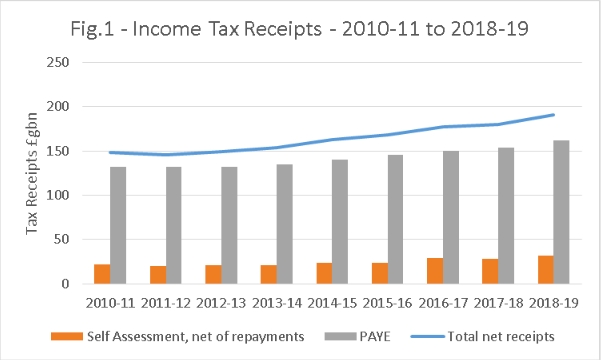

HMRC recently released full income tax receipt statistics for the ten year period from 2007/2008 to 2018/2019. After adjustments for repayments, the last ten years has seen a £40 billion increase in income tax net revenue.

In the 2018/2019 tax year, the Treasury received a total of £191 billion from income taxes. This is made up of £162 billion from PAYE and £31.5 billion from Self Assessment.

The taxman returned £2.7 billion to PAYE taxpayers who had made tax refund claims or through adjustments. £2.2 billion was repaid as tax relief on private pension contributions and £1.35 billion was repaid for gift aid claims. £8 million was repaid in respect of ISA account adjustments.

Ten years ago, in 2008, the Treasury received a total of £153 billion from income taxes. This is made up of £137 billion from PAYE and £22.5 billion from Self Assessment.

Back in 2008, The taxman returned £2.1 billion to PAYE taxpayers who had made tax refund claims or via adjustments. £2.2 billion was repaid as tax relief on private pension contributions and £900 million was repaid for gift aid claims. £160 million was repaid in respect of ISA account adjustments.

PAYE is the tax collection system that automatically deducts the relevant tax and national insurance at each pay period. This can be applied to both earned income from employment, or income from pension schemes. Self Assessment is the annual tax return required for some people with specific circumstances such as having more than one income source, a high income, company directors among other reasons.

A 15 percent increase in PAYE related income tax, but a 40 percent increase is tax through Self Assessment. In ten years the net tax receipts from Self Assessment grew by around £9 billion.