The Chancellor, George Osborne, has today published draft copies of a brand new tax statement to be issued to taxpayers from this October.

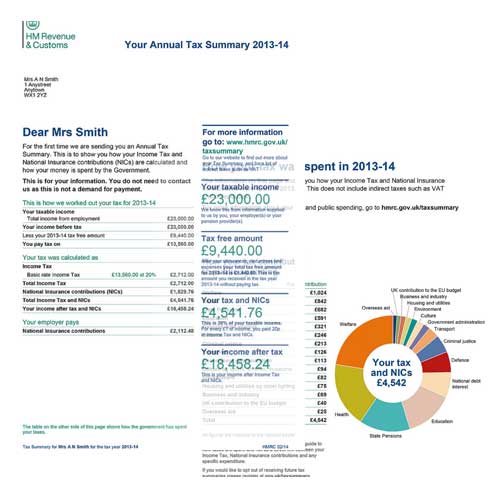

As announced in the 2012 UK Budget, the tax statement will be provided to people to see an overview of how their tax and national insurance contributions were calculated, where the money was spent and their overall average taxation rate.

The Budget announcement stated 20 million people were expected to receive the statement, but the figure stated today was 4 million higher, at 24 million taxpayers. This now includes PAYE (Pay As You Earn) employees who may have more than one employment.

Example statements have been provided for a fictitious taxpayer ‘Mrs Smith’ with various sample taxable incomes of £15,000, £23,000, £30,000, £45,000 and £60,000.

To get a full breakdown of taxation including PAYE and multiple sources of income, taxpayers can use one of the many tax calculators available at http://www.uktaxcalculators.co.uk.

Updated for the past ten tax years and the upcoming 2014/2015 tax year, a full tax statement including effective tax rate and government spending can be generated today, whether there is one, or more than one income source. Other tools available including business tax planners and expenses calculators show methods to help reduce the amount of tax effectively.