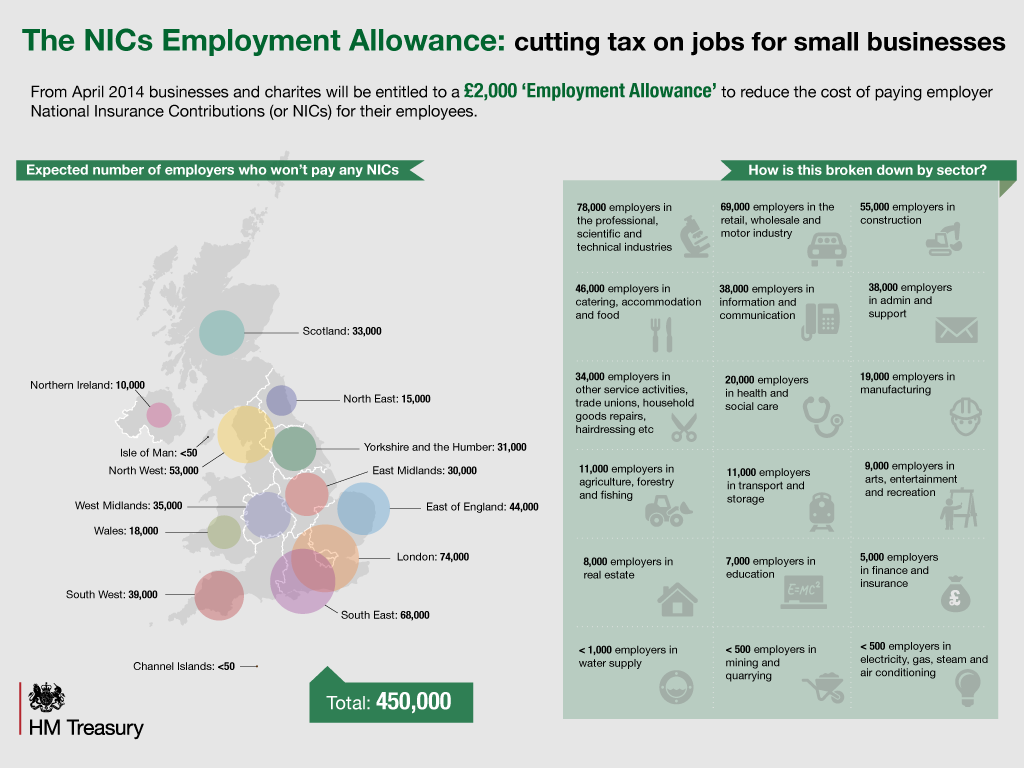

Announced in the 2013 UK Budget, the NICs Employment Allowance was created to ease the tax burden of businesses/charities by reducing the amount of Employer NICs paid by up to £2,000.

Due to be introduced from the start of the new tax year, April 2014, it is predicted to directly benefit up to 1.25 million firms and charities. Firms will be able to claim the allowance via their regular payroll procedure.

The government has provided the following infographic detailing regions and sectors where 450,000 Employer NIC bills will be eliminated.