UKTaxCalculators.co.uk Search!

Get tax help with expert tax guides by the UK's number one tax calculator website!

Leasing a Car Through Your Business

Putting a lease through the company books, or leasing personally and getting expenses? Let's take a look at the differences.

21 July 2019 1:16pm 6,958 views

My First Self Assessment Tax Return

For non-employees, in most cases, HMRC find out how much tax and national insurance to charge you from information you provide on your self assessment. So, what is it and how do you complete one?

19 July 2019 12:54pm 7,136 views

What Happens When You Close a Limited Company?

Closing your business might give you a CGT (Capital Gains Tax) or Income Tax bill. Learn more in our quick guide.

17 July 2019 3:52pm 8,001 views

What is Self-Employed National Insurance

Quick guide to National Insurance Contributions for the self-employed.

15 July 2019 8:50am 5,922 views

Company Car Tax : A Quick Guide

A business providing a car for an employee has a number of tax implications to consider. Here is a quick guide to company car tax.

13 July 2019 2:18pm 6,911 views

What are the Best Ways to Take Salary from my Limited Company?

A limited company opens up many methods of paying yourself. If you opt to take a salary, how much should you take and what other methods are there?

11 July 2019 5:46pm 6,140 views

Directors Loan Account Guide

Read our guide on how to unlock the cash sitting in your company using a director's loan and the related implications.

9 July 2019 3:34pm 12,896 views

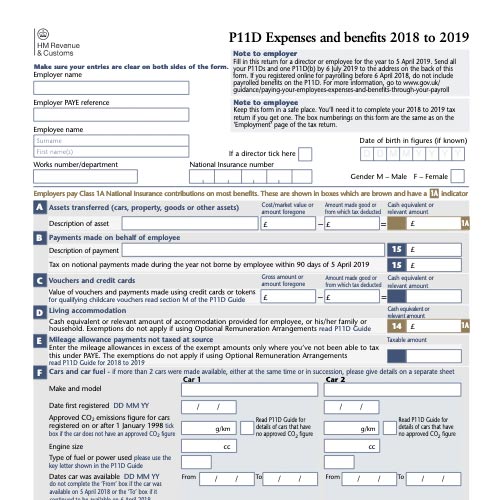

What is a P11D Form?

Non-salary benefits received by an employee are reported to HMRC using a P11D form. Read our simple guide to the P11D.

7 July 2019 1:32am 13,609 views

I'm Running a Small Business, What Taxes Do I Pay?

Small businesses have a myriad of taxes to watch out for. Here's a quick overview guide of the five main ones.

5 July 2019 11:30am 12,747 views

How Can I Use The Marriage Tax Allowance?

Share your personal allowance with your partner and save tax you pay - but there are some things to lookout for!

3 July 2019 11:27am 4,726 views