UKTaxCalculators.co.uk Search!

Get tax help with expert tax guides by the UK's number one tax calculator website!

Salary Inflation Calculator - Is Inflation Taking The Wind Out Of Your Pay?

Compare your 'real' salary from any year when inflation is factored using this Salary Inflation Calculator.

18 December 2019 1:34pm 52,966 views

Lease Car Through Your Business Tax Calculator

How much can you save by leasing your car through your business? Use this calculator to find out.

11 November 2019 12:11pm 20,897 views

What Happens When Changing From a Sole Trader to Limited Company?

Learn when the best time is to become a Limited Company and the associated benefits and requirements.

29 July 2019 3:12pm 7,450 views

Sole Trader - Am I Better Off?

Running a business as a sole trader can have advantages and disadvantages, from legals through to tax. Read our quick guide for a brush up.

27 July 2019 10:10am 6,637 views

Donating to Charity and Saving Tax

Read our quick guide to learn how you can donate to charity personally or through your business, either cash or assets, and save tax.

25 July 2019 4:08pm 10,386 views

Can I Claim Travel Expenses For Contracting Work?

Since 2016 the government has tightened the rules so if you're technically inside IR35 or under supervision, direction or control, then no claims can be made.

23 July 2019 2:05pm 4,990 views

Leasing a Car Through Your Business

Putting a lease through the company books, or leasing personally and getting expenses? Let's take a look at the differences.

21 July 2019 1:16pm 5,700 views

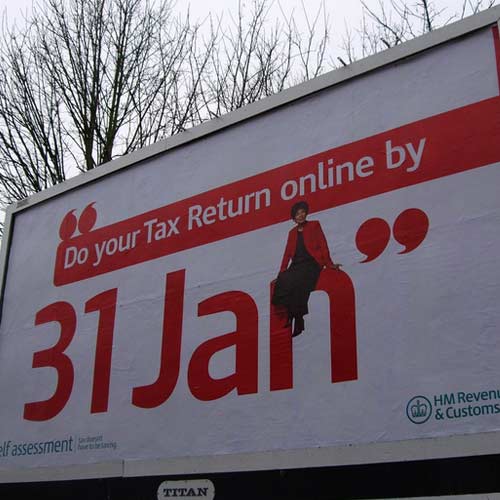

My First Self Assessment Tax Return

For non-employees, in most cases, HMRC find out how much tax and national insurance to charge you from information you provide on your self assessment. So, what is it and how do you complete one?

19 July 2019 12:54pm 6,027 views

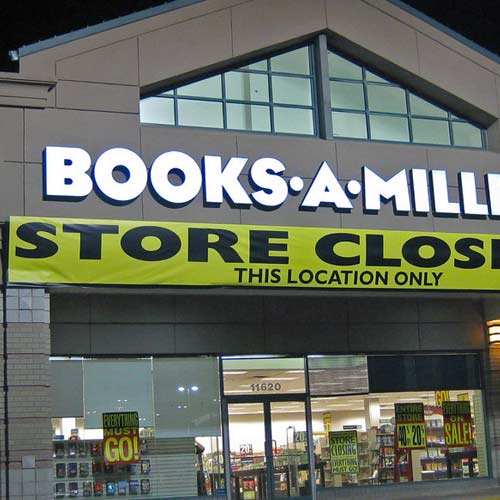

What Happens When You Close a Limited Company?

Closing your business might give you a CGT (Capital Gains Tax) or Income Tax bill. Learn more in our quick guide.

17 July 2019 3:52pm 6,968 views

What is Self-Employed National Insurance

Quick guide to National Insurance Contributions for the self-employed.

15 July 2019 8:50am 4,859 views