With local services under pressure and valuations anchored to 1991/2003, revamping Council Tax is back on the agenda. The Labour government has initiated a fair funding review of local government finance, aiming to rebalance central grants toward more deprived councils—creating inevitable "winners and loser" as noted by the Institute for Fiscal Studies (IFS).

Options in active debate include:

- Revaluation and additional bands to reflect current property values and increase progressivity, particularly at the top end.

- A local property tax tied to current values to replace or substantially overhaul Council Tax. Proposals discussed publicly include a flat starter charge (e.g., £800 up to £500,000) with higher rates above that, or a proportional structure. Advocacy group Fairer Share suggests a flat 0.48% of market value. - and we've created a property tax calculator based on that.

- Adjacent property tax reform such as replacing Stamp Duty Land Tax (SDLT) with a national property tax on owner-occupied homes to boost housing mobility; and controversial ideas like applying CGT on very high-value primary residences ("mansion tax” concept).

According to media reporting and market commentary, announcements are expected in the Autumn Budget 2025, with any Council Tax overhaul unlikely before 2026 and potentially not before 2029 (requiring a second term). These changes would likely include transitional protections to smooth bill changes and avoid "sticker shock".

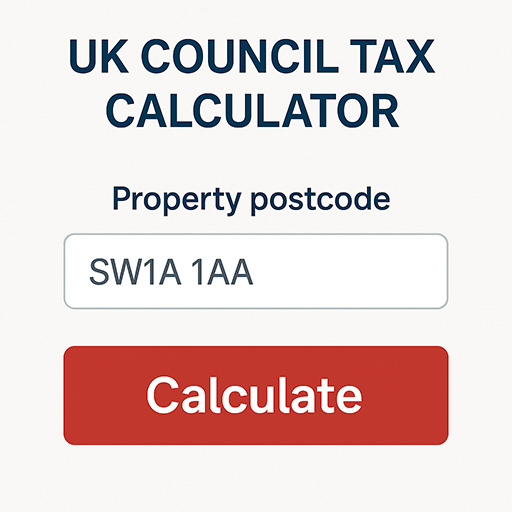

Use our quick Council Tax calculator or continue reading to learn more about Council Tax.

How Council Tax works

Council Tax is a local charge on domestic properties to help fund local services. Each property is assigned a valuation band based on a reference valuation date that differs by country: England and Scotland use 1 April 1991, while Wales uses 1 April 2003 following a revaluation. Your local authority sets a Band D amount each year, and each band pays a fixed proportion (a "multiplier”) of the Band D charge. Police, fire and parish bodies can add their own precepts to your bill.

In England, an Adult Social Care precept can be added to support social care services for older and disabled residents. Increases each year are bounded by "referendum principles" determined by central government.

Who pays? Generally the residents are liable (tenants if renting); if a property is unoccupied, the owner is usually liable. Special rules apply for exempt groups such as full-time students and people who are severely mentally impaired.

Learn more: GOV.UK – Council Tax overview; VOA – Bands; Scottish Government; Welsh Government.

Council Tax bands, valuation dates and multipliers

England

England uses bands A–H based on 1991 values. Multipliers relative to Band D are A=6/9, B=7/9, C=8/9, D=9/9, E=11/9, F=13/9, G=15/9, H=18/9. Your council publishes the annual Band D charge, and the band multiplier determines your bill before discounts or precepts.

Wales

Wales uses bands A–I based on 2003 values. Multipliers mirror England’s A–H with an additional Band I at 21/9 of Band D to improve progressivity at the top end.

Scotland

Scotland uses the same 1991 base as England and the same multipliers for A–D, but since 2017 applies higher multipliers to Bands E–H to increase progressivity (E≈1.31, F≈1.63, G≈1.96, H≈2.45 relative to D=1).

Learn more: GOV.UK – Banding and valuation; Welsh Government; Scottish Government.

Top 10 Cheapest Council Tax Areas in the UK

- Wandsworth - ranges from £665 to £1,996.

- Westminster - ranges from £679 to £2,038.

- City of London - ranges from £849 to £2,548.

- Hammersmith and Fulham - ranges from £968 to £2,903.

- Kensington and Chelsea - ranges from £1,061 to £3,183.

- Tower Hamlets - ranges from £1,170 to £3,509.

- Windsor and Maidenhead - ranges from £1,216 to £3,647.

- Newham - ranges from £1,237 to £3,712.

- Southwark - ranges from £1,252 to £3,756.

- Isles of Scilly - ranges from £1,300 to £3,900.

Top 10 Expensive Council Tax Areas in the UK

- Rutland - ranges from £1,781 to £5,342.

- Nottingham - ranges from £1,771 to £5,312.

- Dorset Council - ranges from £1,754 to £5,261.

- Lewes - ranges from £1,752 to £5,255.

- Wealden - ranges from £1,739 to £5,217.

- Bristol - ranges from £1,723 to £5,168.

- Newark and Sherwood - ranges from £1,721 to £5,164.

- Gateshead - ranges from £1,719 to £5,157.

- West Devon - ranges from £1,716 to £5,149.

- Rother - ranges from £1,708 to £5,123.

What does Council Tax pay for?

Although details vary by council, Council Tax typically funds:

- Adult social care (home care, residential care, support for disabilities)

- Children’s services (safeguarding, fostering, adoption)

- Waste collection and recycling; parks and green spaces

- Local highways, street lighting and transport support

- Libraries, leisure centres and culture

- Police and fire via separate precepts; parish councils via parish precepts

Rising demand for social care has pushed a higher share of budgets toward care, forcing savings elsewhere. Learn more: DLUHC; NAO.

Discounts, exemptions and how to save on Council Tax

- Single Person Discount (25%): if only one countable adult lives in the property.

- Disregards: full-time students, severely mentally impaired (SMI), apprentices, certain carers, under‑18s, diplomats and some religious community members are "not counted.”

- Full exemptions: all-student households; all-SMI households; homes empty due to care, probate, or repossession (time-limited in some cases).

- Council Tax Reduction (CTR): means-tested help for low-income households—up to 100% reduction depending on local/national scheme.

- Disabled Band Reduction: if home adaptations for a disabled resident qualify, your band may be reduced by one.

- Annex rules: family annexes can get a 50% discount; dependent relative annexes can be fully exempt.

- Challenge your band: check evidence and appeal via the VOA (England/Wales) or the Assessor (Scotland); refunds can be backdated if successful.

- 12-month instalments: request to spread payments across 12 months instead of 10 to cut monthly outgoings.

- Discretionary hardship relief: ask your council about s13A(1)(c) reductions in exceptional hardship.

Learn more: GOV.UK – Who pays and discounts; Disabled Band Reduction; Annex discounts; Check your band; Citizens Advice – CTR.

Penalties and enforcement if you miss payments

If you miss an instalment, the council will issue a reminder. Continued non-payment typically triggers a final notice (ending the right to instalments), followed by a court application for a Liability Order (England/Wales) or a Summary Warrant (Scotland). Enforcement can then include:

- Enforcement agents/bailiffs (England/Wales) with statutory fee stages: Compliance £75; Enforcement £235 + 7.5% over £1,500; Sale £110 + 7.5% over £1,500.

- Attachment of earnings or benefits deductions.

- Charging order (often for debts over ~£1,000) and, rarely, bankruptcy (commonly >£5,000).

- Committal to prison (England/Wales) is rare and only for wilful refusal/culpable neglect; not used in Scotland.

If you are vulnerable (e.g., serious illness, mental health, recent bereavement), inform the council; cases can be handled differently. Learn more: Citizens Advice; Taking Control of Goods (Fees) Regs 2014.

FAQs

Why are valuations so out of date?

Revaluation is politically and administratively challenging; values diverged widely since 1991/2003, so updating would create large redistribution across regions. That’s why reforms typically discuss transitional caps and phased changes.

Will my bill go up under the proposed council tax changes?

Depends on your property value relative to local averages. Reforms tend to raise bills for high-value properties (often in London/South East) and reduce them for lower-value regions. Governments usually phase changes to avoid shocks.

As a renter, should I care?

Yes. Though landlords often "pass through” Council Tax by setting who pays in tenancy agreements, broader Council Tax reforms affect local service funding and can indirectly influence rents, mobility and local amenities.