The UK property market could see major upheaval as the government considers replacing the current Stamp Duty Land Tax (SDLT) with a new property tax. Spearheaded by Chancellor Rachel Reeves as she continues efforts to address a £40 billion fiscal deficit, the changes have sparked debate among homeowners, industry experts, and policymakers. We have created a property tax calculator using assumptions from think-tanks but we won't know until later this year in Autumn Budget 2025 if the proposals are to go ahead. In the meantime let’s explore what a new property tax could mean for the UK.

The Current System: Stamp Duty Land Tax (SDLT)

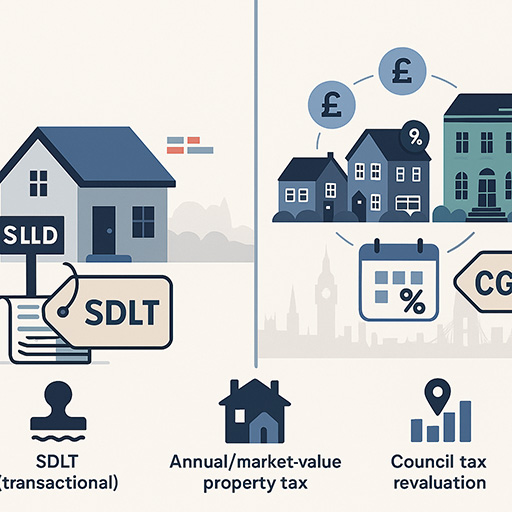

Stamp Duty Land Tax is a transactional tax paid by buyers when purchasing property in England and Northern Ireland. The rates are tiered, starting at 0% for properties up to £125,000 and rising to 12% for properties over £1.5 million. First-time buyers benefit from relief on properties up to £300,000, while additional property buyers face a 3% surcharge. Non-residents also pay an extra 2% surcharge.

Stamp duty generates significant revenue for the Treasury, but has long been criticised for distorting the housing market. By taxing transactions, SDLT discourages property sales, particularly among older homeowners looking to downsize. This has contributed to a lack of housing mobility and exacerbated the UK’s housing supply issues.

A New Property Tax?

Several options are on the table to replace SDLT with a more equitable and efficient system. Here are the key proposals under consideration:

National Property Tax

A national property tax could replace SDLT for owner-occupied homes. This tax would be proportional to the property’s value, potentially starting at homes worth over £500,000. Unlike SDLT, which is paid at the point of purchase, a national property tax could be levied annually or upon sale. This shift would aim to reduce the upfront financial burden on buyers, particularly first-time buyers.

Council Tax Overhaul

Council tax, based on outdated 1991 property valuations, is also under scrutiny. The government is considering replacing it with a local property tax tied to current market values. It's unlikely to occur before 2029, but this reform would address regional disparities, where properties in London and the South East are under-taxed compared to those in the North. A revaluation could see properties worth up to £500,000 paying a flat annual rate of £800, with higher rates for more expensive homes.

Advocacy group Fairer Share suggests a flat rate of 0.48% of a property’s market value as a replacement for council tax.

Mansion Tax

A mansion tax targeting high-value properties is another option. Homes worth over £1.5 million could face a capital gains tax (CGT) on sale, removing the current private residence relief. Higher-rate taxpayers might pay 24% on gains, while basic-rate taxpayers could pay 18%. This proposal aims to address wealth inequality but has raised concerns about market distortions and reduced downsizing.

Over 120,000 homeowners could be affected, with average CGT bills estimated at around £200,000 for higher-rate taxpayers.

Who sets to gain from the changes?

- First-Time Buyers: Replacing SDLT with a proportional property tax could lower the upfront costs of buying a home, making it easier for first-time buyers to enter the market.

- Low-Value Property Owners: A revaluation of council tax could reduce bills for owners of lower-value properties, particularly in the North and Midlands.

- The Housing Market: Removing SDLT could increase housing mobility, encouraging more transactions and freeing up larger homes for families.

Who sets to lose from the changes?

- Wealthy Homeowners: High-value property owners could face significantly higher taxes under a mansion tax or revalued council tax system.

- Landlords and Investors: Additional levies on buy-to-let properties and second homes could increase costs for landlords, potentially leading to higher rents.

- Older Homeowners: A mansion tax or CGT on primary residences could discourage downsizing, reducing the supply of family homes.

While the proposed reforms aim to create a fairer tax system, they face several challenges.

- Political Resistance: Wealthier homeowners and landlords are likely to oppose higher taxes, particularly in London and the South East.

- Market Distortions: Threshold-based taxes, such as a mansion tax, could create artificial price ceilings, discouraging transactions just above the threshold.

- Administrative Complexity: Implementing a proportional property tax or revaluing council tax bands would require accurate and frequent property valuations, a costly and time-consuming process.

- Short-Term Revenue Loss: Replacing SDLT with an annual property tax could lead to short-term revenue losses for the Treasury, exacerbating the UK’s fiscal deficit.

The Autumn Budget 2025 is expected to provide more clarity on these proposals. If implemented, the reforms could take effect as early as 2026. However, some changes, such as a council tax overhaul, may require a longer timeline, potentially extending into a second Labour term.