Retirement planning is one of the most critical financial decisions individuals face. Pensions have long been a cornerstone of retirement income, offering flexibility and tax advantages. However, recent changes to inheritance tax (IHT) rules and evolving economic conditions have sparked debates about the sustainability of traditional withdrawal strategies, such as the 4% rule, and the potential shift to higher withdrawal rates like 6%.

Here we explore the background of UK pensions, the implications of IHT changes, and how people can optimise their withdrawal strategies. We've built this tool to compare the 4% vs 6% pension withdrawal strategies as well as a custom withdrawal rate.

Understanding UK Pensions

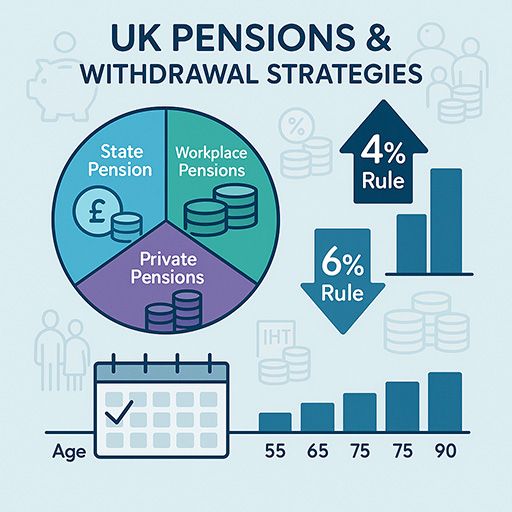

Our pension system is built on three main pillars:

- State Pension: A government-provided income based on National Insurance contributions. As of 2025, the full new State Pension is approximately £11,973 annually.

- Workplace Pensions: Auto-enrollment schemes where employees and employers contribute to a defined contribution (DC) pension pot.

- Private Pensions: Personal savings plans, such as Self-Invested Personal Pensions (SIPPs), offering tax relief on contributions.

Pensions are designed to provide a steady income in retirement, but the flexibility introduced by pension freedoms in 2015 allows individuals to access their savings from age 55 (rising to 57 in 2028). This freedom has led to increased reliance on withdrawal strategies to ensure funds last throughout retirement.

The 4% Rule: A Traditional Approach

The 4% rule, developed in the 1990s, suggests withdrawing 4% of your pension pot in the first year of retirement and adjusting for inflation annually. This approach aims to ensure a 30-year retirement without depleting savings.

While the 4% rule has been a reliable guideline, it assumes stable market returns and does not account for individual circumstances, such as health, lifestyle, or unexpected expenses.

Inheritance Tax and the Case for Moving to the 6% Rule

Recent changes to IHT rules, effective from April 2027, have prompted retirees to reconsider their strategies.

Previously, unused pension pots could be passed on tax-free. However, from 2027, unspent pension funds will be subject to IHT at 40%, significantly reducing the amount beneficiaries receive.

This shift has led to the rise of the 6% rule, which encourages retirees to spend more of their pension during their lifetime. By withdrawing at a higher rate, individuals can enjoy their savings while minimising the tax burden on their estate.

Inheritance tax is charged at 40% on estates above the £325,000 threshold (or £500,000 if the residence nil-rate band applies). The inclusion of pension pots in IHT calculations from 2027 will affect many retirees, especially those with significant savings.

Key considerations:

- Tax Efficiency: Beyond the 25% tax-free lump sum, pension withdrawals are subject to income tax. Retirees must balance withdrawals to avoid higher tax brackets.

- Longevity Risk: With life expectancy increasing, retirees must ensure their funds last, even with higher withdrawal rates.

- Care Costs: Late-life care expenses can be substantial, requiring careful planning.

Using our 4% vs. 6% Pension Withdrawal Calculator

To help people navigate these complexities we build this 4% vs. 6% pension withdrawal strategy calculator. It's a user-friendly tool to model different scenarios. Here’s a step-by-step guide:

Input Your Pension Details: Enter your current pension pot value. Specify your current age and the age you plan to start withdrawals.

Set Key Parameters: Choose the age to take your 25% tax-free lump sum. Input expected annual growth (default: 6%) and inflation rates (default: 2.5%).

Explore Contribution Options: Add ongoing contributions, including employer matching and tax relief. Adjust for inflation to see how contributions impact sustainability.

Compare Withdrawal Strategies: The calculator provides projections for the 4% rule, 6% rule, and custom rates. View detailed year-by-year breakdowns, including pot value, withdrawals, and contributions.

Results are updated immediatedly, so you can compare outcomes at key ages (e.g., 75, 85, 90). Identify the strategy that aligns with your goals, whether it’s maximising lifetime income or preserving funds for inheritance.