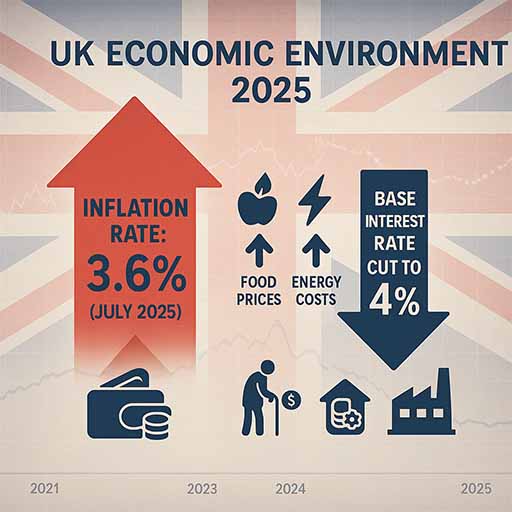

The Bank of England (BoE) has cut the base interest rate by 0.25 points to 4 percent, marking the lowest level in over two years. It was February 2023 when base rates were at 3.5 percent for a few months, prior to which they were at 3 percent. Today's decision, reached amid a continued challenging economic landscape, was narrowly endorsed by the Monetary Policy Committee (MPC), with a split vote of five in favor to four opposed. Notably, one member had advocated for a steeper 0.5 percent cut. For perspective, rates had been at 4.25 percent since May.

UK Consumer Price Index (CPI) inflation is running at 3.6 percent, up from 3.2 percent in April. This is still above the Bank of England’s 2 percent target. The recent uptick is blamed on poor harvests, global supply chain issues, and higher labour costs in the food sector. Today's rate cut is going ahead even with inflation set to rise to 4 percent in September 2025 before gradually falling back towards the 2 percent target in 2026. The BoE is trying to balance supporting growth and jobs while not letting inflation bloat away.

So, how does this affect you? We'll look at mortgage holders and savers.

You can use our calculator to see how the cut affects your mortgage payments.

Effects on Mortgage Holders

Homeowners with base tracker or discounted variable-rate mortgages are set to benefit immediately, with calculations suggesting that even a 0.25 percent decrease can translate to savings of around £30 per month on a typical £140,000 mortgage. This reduction significantly eases monthly financial pressures and boosts disposable income.

Borrowers on fixed-rate deals are shielded from immediate fluctuations until their deal expires; however, the ongoing competitive environment means that new fixed-rate mortgage offerings have been revised downward, with two-year fixes now starting from rates as low as 3.79 percent.

With approximately 1.6 million fixed-rate mortgages due for renewal in 2025, there has been a surge in remortgaging as homeowners seek to lock in lower fixed rates. Lenders, responding to market conditions, are increasingly offering sub-4 percent deals to secure their customer base.

A less obvious effect is on first-time buyers. Lowered mortgage rates allow for improved affordability tests for first-time buyers. With lower monthly payments and more competitive fixed deals, the property market could see improved accessibility for those entering the market for the first time.

Effects on Savers and Investments

The general reduction in base rates impacts the returns on savings accounts, particularly easy-access accounts, whose average rates now hover around 2.78 percent. Even the best high-street and challenger banks are forced to lower their rates in response to the reduced cost of funds.

Cash ISAs have become increasingly popular because they provide the dual advantage of competitive rates and tax-free savings. Savers are now seeking out one-year fixed-rate ISAs that offer up to 4.16 percent. However, the overall declining trend means that locking in a rate now becomes more strategic.

Financial experts recommend that savers take immediate action to secure higher fixed rates before further cuts potentially erode returns further. Diversification remains key—some experts suggest that beyond cash savings, venturing into bonds, equities, or other forms of investment may offer better hedges against inflation.

With inflation currently running above 3.6 percent, even the best fixed savings products may struggle to generate positive real returns. This dynamic reinforces the importance of using tax-efficient instruments like ISAs to save or invest while preserving purchasing power.

For pensioners the lower savings and annuity rates could affect pension income. As the base rate falls, annuity rates also tend to decrease, potentially reducing the guaranteed income available to pensioners. This has led many experts to advise a review of retirement portfolios.

The decision was influenced by:

-

Stagnating Growth and Recession Fears

Economic growth has been tepid, and there is mounting concern about a potential recession. Although aggressive rate hikes had previously been employed to tame rising prices, the current environment calls for a policy shift towards stimulating growth rather than curbing inflation aggressively.

-

Inflation Pressures

Inflation remains persistent, even as a result of rising food prices and increased employment costs. With inflation forecasts now predicting a surge to 4 percent in September 2025; and food inflation possibly reaching 5.5 percent; the BoE aims to ease financial pressures on households and businesses.

-

Employment Concerns

The unemployment rate has crept up to 4.7 percent as of May 2025, the highest in four years, with future projections suggesting a further increase. Rising unemployment levels create additional pressures on consumer spending, which in turn affect overall economic performance.

-

Balancing Act

Governor Andrew Bailey and his colleagues at the BoE have acknowledged the inherent complexities in managing the dual mandate of supporting growth on one hand and controlling inflation on the other. The rate cut is thus a cautious signal that while monetary easing will continue, it must be done in a measured, gradual fashion.

The Base Rate Rollercoaster

-

Pre-Pandemic Stability

In 2019, the BoE maintained the base rate at 0.75 percent, reflecting stable economic growth.

-

Pandemic Response

In early 2020, as the pandemic upended global markets, the base rate was swiftly reduced first to 0.25 percent and then to an unprecedented 0.10 percent in March 2020. These cuts were designed to support the economy when uncertainty and reduced consumer spending hung heavily over financial markets.

-

Post-Pandemic Inflation and Rate Hikes

In response to the rebound in economic activity and escalating inflation pressures, the base rate saw successive increases during 2022 and 2023, reaching a peak of 5.25 percent in August 2023. These hikes were part of the BoE's efforts to combat inflation by tightening overall credit conditions.

-

Recent Adjustments

Recognising a need for economic stimulus, the BoE began cutting rates again in 2024, with reductions to 5.00 percent in August and further down to 4.75 percent by November. In 2025, the trend continued with cuts to 4.50 percent in February, 4.25 percent in May, and ultimately to 4.00 percent in August.

Considering the decisions made to deal with problems in the past, analysts have made the following predictions for the direction the base interest rate could take in the near and far future.

-

Gradual Easing Expected

The Bank of England itself has signalled that any future cuts will be gradual and cautious, dependent on inflationary trends and broader economic growth indicators. Some forecasts predict two additional rate cuts in 2025, potentially bringing the base rate to around 3.75 percent by year’s end.

-

Diverse Financial Opinions

Major financial institutions, including HSBC, UBS, and Capital Economics, have forecast varying outcomes. While HSBC and UBS expect a drop in the base rate to about 3 percent by the end of 2026, Capital Economics suggests a more moderate decline, envisioning early 2026 levels around 3.5 percent, with some analysts projecting a final outcome of around 4 percent by the end of 2026.

-

Long-Term Projections

Oxford Economics offers a slightly more optimistic perspective, suggesting that if conditions improve, the base rate could fall below 3 percent by 2027.