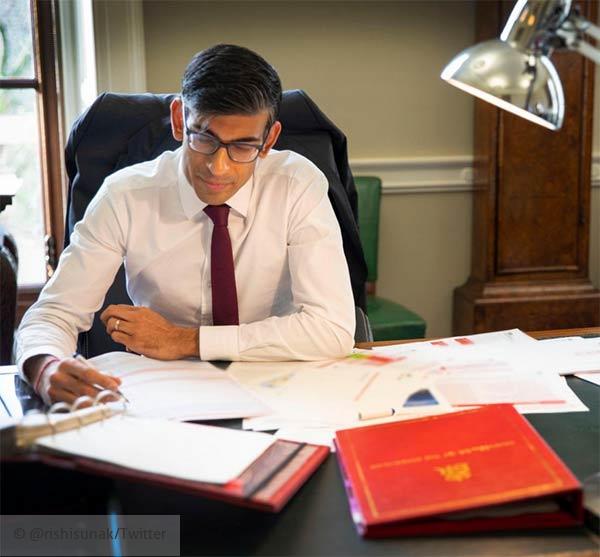

Chancellor Rishi Sunak just gave his economy update as part of the PM Boris Johnson's daily virus briefing. Once again the Chancellor has further extended his package of support.

The extended measures come as the government announces all pubs, bars, gyms, cafes, restaurants and non-essential shops/public gathering places to close from this evening until further notice.

Updates include:

- Government grants to businesses to cover employee wages for non-working furloughed employees. Up to 80% of the salary (to a max of £2,500 per month) can be claimed by companies to keep staff employed and paid. Employers will be able to apply as soon as the system is in place (hopefully by April 30th) and have claims backdated to March 1st. Employers are also free to top-up to 100% of their employee's salary if they wish. Calculate 80 percent of your salary and take home pay to see how this could possibly affect you.

- The scheme for furloughed employees will run from March 1st to June 30th as a minimum - with possible extensions depending on continuation of partial lockdowns.

- The salary referred to above would not include any overtime, commission or bonuses. Employers will also be given additional money to cover employers' national insurance contributions and the minimum auto-enrolment pension contribution they make.

- £1 billion extra to increase housing benefit element of Universal Credit to cover 30% of market rents when calculating housing rental costs.

- VAT bills for the current quarter have been deferred to June 2020.

- Self Assessment Payment on Accounts due this July 31st (2020) have been deferred to January 2021.

- Universal Credit/Tax Credits maximums have been increased by £1,000 (per year).

- Self employed people have minimum income floor removed from Universal Credit so can claim the equivalent of SSP (Statutory Sick Pay) - a maximum of £94 a week.

We wrote earlier today that we hoped the chancellor would do more than the rumoured freezing of employer PAYE, and thankfully he has, and gone further than underwriting 75% of wages to 80% of gross wages.

Unfortunately the last point in the list of today's updates mentions self employed people. A workforce of millions who can only claim to a maximum of SSP and through the flawed Universal Credit system. Around £400 a month will not cover many people's expenses, as evidenced by looking through thousands of tweets from concerned freelancers/gig workers/self employed sole traders.

The chancellor writes in his statement from today that he will announce further measures next week. Considering the extensions that support has seen since the start of this week, we hope to see the self employed provided with a proper safety net after the weekend.