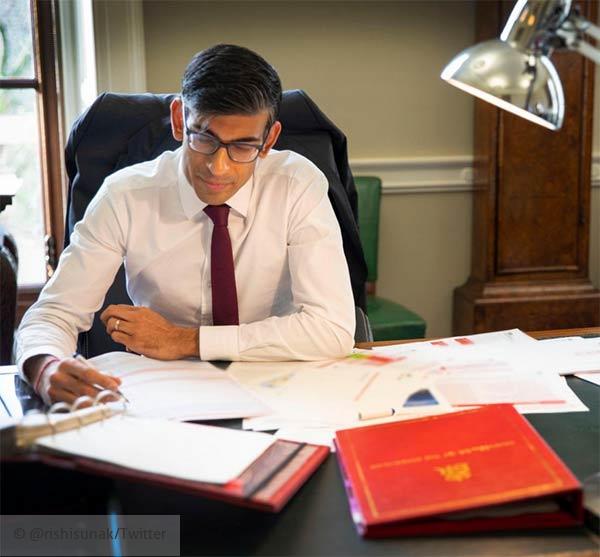

It was confirmed earlier in the year that the cut to income tax via national insurance for taxpayers from April 2020 is going ahead. We have already updated our calculators to show this change when selecting the 2020 tax year, but what else has Chancellor Rishi Sunak got in store this coming Wednesday, March 11th?

We know about NIC thresholds being raised, saving people around £100 a year compared to now, but are personal allowances going to be frozen? - the Scottish parliament recently unveiled their Budget and did so on their expectation that UK personal allowances will be frozen at current levels, £12,500.

The Coronavirus is all over the headlines at the moment and rightly so considering the spread of the virus and potential of high transmission, mutation and a currently higher than flu (3 percent) mortality rate. Sunak has considered the effect containment measures will have on the economy, medical services and the population and will announce a financial package to help in his Budget.

Hundreds of millions of pounds could potential be allocated in the package to provide emergency support for the emergency services and those affected by Coronavirus including people and businesses. It is also expected to help self-employed people who could see income disappear for a period and have no back up such as sick pay. If the measures Sunak provides are not enough, the Bank of England is also expected to stimulate the economy.

In order to meet climate change targets it is believed Sunak will possibly be putting an end to the freeze on fuel duties - starting with diesel subsidies for construction and farming, he may extend to hitting the escalator on fuel for all vehicles. Not only will this be an end to the more widely known, 'red diesel', but this would be an end to a decade of holds on fuel duty for the UK's motorists.

As an example, Red Diesel has a duty of around eleven pence compared to fifty-eight pence for motorists. This is a considerable saving for farming/construction businesses using forklifts, differs, generators and other specialist equipment.

Sajid Javid, Sunak's predecessor stated that he planned to invest in widespread electric vehicle charging infrastructure - will Sunak carry out his fuel duty raises and invest the income in electric vehicles? We know that the government is committed to banning new sales of combustion engine vehicles by 2035. Either way, the removal of duties will net the Treasury billions.

Javid also planned an overhaul of Stamp Duty and Sunak is set to follow. Non-UK residents purchasing property in the UK are expected to pay a three percent surcharge on Stamp Duty. This would be charged on top of the three percent they pay on top of regular Stamp Duty already due to likely buying a property to let or second home. London will be affected the most where one eight of property sales are to non-UK residents. However, there is some feeling that maybe the three percent surcharge for buy-to-let/second homes may not survive the Budget. PM Boris Johnson has previously stated that Stamp Duties are too high and professional bodies for landlords may convince him to remove the surcharge.

Javid planned to remove pension tax relief for higher earners, but his refusal to change his plans ultimately led to his resignation - Sunak will most likely not be removing pension tax relief for higher earners.

Contractors are expected to be hit with IR35 changes with no changes to policy. Engaging companies will be responsible for deciding the tax status of contractors. So far Sunak has only commented that he has asked HMRC to be lenient for the first year from introduction to the updated legislation.

There will likely be more speculation in the lead up to Budget 2020 and we will continue to update. Keep track here and make sure to follow our Twitter on Budget Day for full coverage.