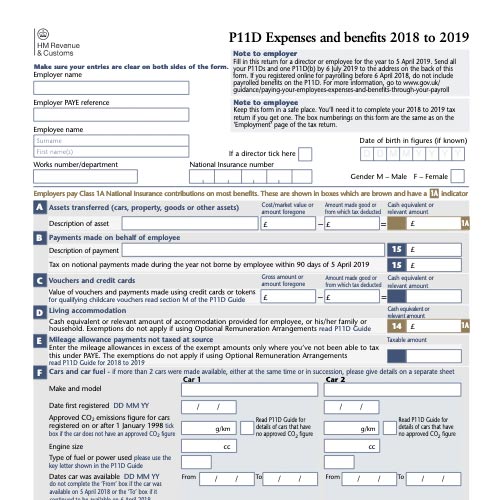

The P11D

The form is used to by your employer to report to HMRC any work-related taxable benefits and expenses for any particular tax year. If the benefits and expenses reimbursed were taxable and were detailed on your payslip already then they won't appear on the P11D form. Taxable expense reimbursements may be minimised if they are called as 'business expenses' and can therefore be omitted from the form. This includes business related travel, fees, subscriptions and more.

This form is purely to notify that the Taxman that you have had taxable benefits and tells them the 'cash value' of the benefits to tax.

What can I find on my P11D?

Your P11D will show all the benefits and expenses, that were not part of your salary, that you should pay tax on. The list can be extensive, but in general you can expect things like Company Cars, Fuel Benefits, Medical Insurance, Childcare, Loans are more.

These kinds of items will have a cash value that tax must be calculated on.

How do I pay my P11D?

Your employer is responsible for filing the form by July 6th after the end of the related tax year. The calculation of tax would need to be made by July 22nd. A copy of the P11D form should be provided to the employee in the same period.

HMRC can funnel your tax due into your tax code - so the adjusted (lower) tax-free allowance dictated by the tax code would cover the benefit in kind tax due.

Employers must pay Class 1A National Insurance on the benefits they provide. For example, on company cars, currently an amount equivalent to 13.8% of the of the benefit is paid. The benefit on cars calculated on the 'cash value' of the car multiplied by it's BiK rate (which is based on CO2 emissions).

Employers are able to also deduct tax on benefits through payroll - but will need to submit a P11D(b) form to report their employers national insurance Class 1A liability.