After an initial breach on April 1st, the offshore law firm Mossack Fonseca saw 11.5 million files leaked last week. Amongst the data, 143 politicians were found to be evading tax by using offshore tax havens, including 12 leaders named either directly or through association.

Names such as Vladimir Putin, the Russian president and Nawaz Sharif the Pakistani PM were outed. Putin was shown to be transferring money from Russian state banks to offshore entities, including a ski resort.

An interesting revelation, particularly for UK press, was the inclusion of an offshore investment fund run by Ian Cameron, the late father of the PM. Even though the fund, Blairmore Holdings Inc, had been registered with the Taxman and was providing detailed annual tax returns, it was avoiding tax by being managed and controlled overseas.

Blairmore was registered in Panama and based in the Bahamas by utilising up to 50 Bahamian residents to fulfill official roles in the company such as treasurer or secretary. Founded in the early 80s, the fund managed the wealth of hundreds of wealthy families and is even now managing assets of around £35 million. It has been reported that through the specific tax arrangement in the thirty years since it was created the fund paid no UK taxes.

Today the fund is based in Ireland and under European regulations. So, why has the focus fallen on David Cameron?

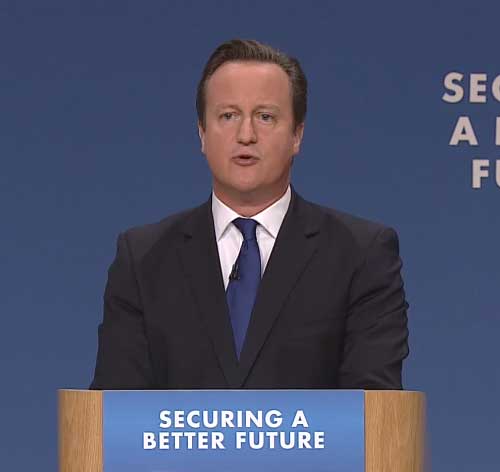

In Singapore 2015, David Cameron makes a speech stating that the people using anonymous company structures, such as above, are of the criminal fraternity. When the Panama story broke, the PM called for privacy on the matter saying it should be dealt with by the relevant authorities. By stating this the press claimed he has something to hide, possibly even a stake in the offshore fund. The spiraling accusations and spotlight led to the Prime Minister publishing a 'summary' of his income and taxes from 2009 to 2015.

The letter from his accountants aimed to divulge that there was no foul play and indeed the last six years do not show any obvious wrongdoing. The year in which the Conservatives came to power as part of the coalition show he received a tiny £114 dividend, something that could come from a stake in a company/fund/shares but nothing post that year.

David Cameron's Account Summary

Interesting highlights include:

- The PM's salary has increased from £120k to £140k in five years.

- David Cameron used the addition tax allowance of £20k for 4 years but since 2014 has waived it.

- Royalties from the PM's book, 'Cameron on Cameron' were donated to charity after receiving £3k in 2010.

- Shares were held in 'Blairmore'. The gain on disposing the shares in 2010 was £10k.

- A spike in 'High Street Bank interest' occurred in 2012-13 coinciding with when the PM received an inheritance.